Some functions to calculate accrual and depreciation of assets in Excel

- 24-07-2022

- trienkhaiweb

- 0 Comments

To help you work faster when calculating in Excel. The following article will summarize the most detailed functions for calculating interest, accumulated principal, and asset depreciation on Excel.

Mục lục

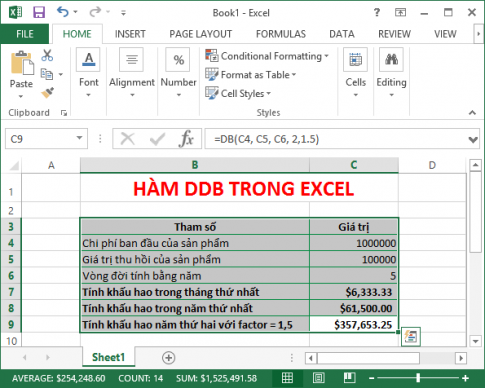

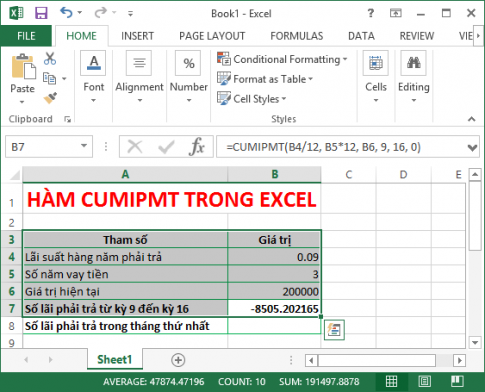

first . CUMIPMT . function

- Function: calculate the accrued interest for the loan from the first period to the last period.

- Syntax: CUMIPMT (rate, nper, pv, start_period, end_period, type)

- Using:

-Rate: Interest rate, required parameter

-Nper: Total number of payment periods, required parameter

-Pv: Current value, required parameter

-Start_period : First period, required parameter

-End_period: Last period, required parameter

-Type: Payment term, required parameter

+ Type = 0 : Payment at the end of the period

+ Type = 1 : Payment at the beginning of the period

Example: For the following spreadsheet, the values entered correspond to the parameters of the function in Excel. Let's calculate:

– Interest payable on the loan from period 9 to period 16

-The amount of interest payable in the first month

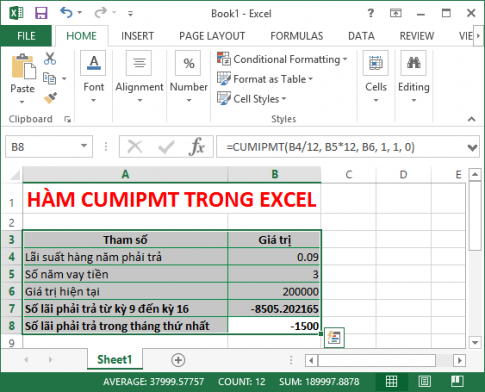

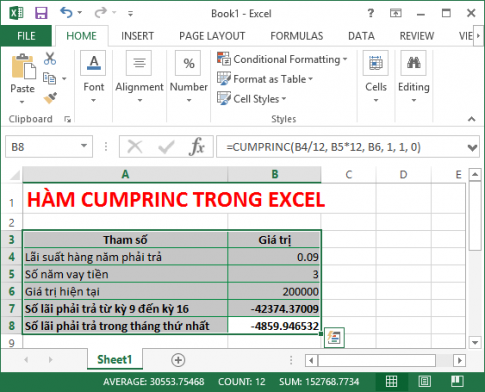

2 . CUMPRINC . function

- Function : calculate the accumulated principal amount paid for the loan from the first period to the last period.

- Syntax: CUMPRINC(rate, nper, pv, start_period, end_period, type)

- Using:

-Rate: Interest rate, required parameter

-Nper: Total number of payment periods, required parameter

-Pv: Current value, required parameter

-Start_period : First period, required parameter

-End_period: Last period, required parameter

-Type: Payment term, required parameter

+ Type = 0 : Payment at the end of the period

+ Type = 1 : Payment at the beginning of the period

Example: Given the following worksheet, the values entered correspond to the parameters of the function in Excel, calculate:

-Total principal payable of the loan from period 9 to period 16

-Total principal payable in the first month

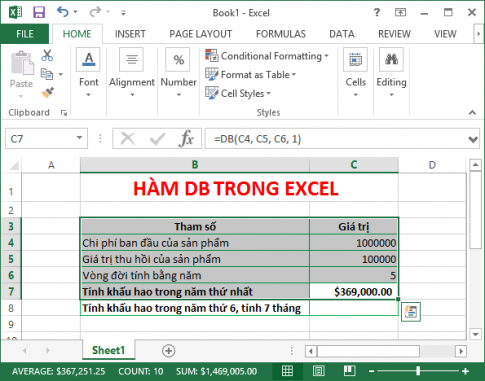

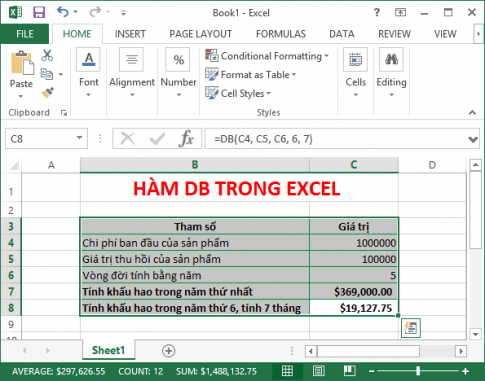

3 . DB . function

- Function: calculate the depreciation of assets with specific maturities according to the fixed declining balance method.

- Syntax: DB(cost,salvage,life,period,[month])

- Using:

-Cost: initial cost of the product, required parameter

-Salvage: value after depreciation (recovery value of the asset), required parameter

-Life: Number of depreciation periods, required parameters

-Period: Period you want to depreciate, required parameter

-Month: The number of months of the first year, if omitted, the default is 12

Example: Given the spreadsheet as shown below, with the entered data equivalent to the parameters of the DB function in Excel, calculate:

– Depreciation in the first year:

-Depreciation in the 6th year in 7 months

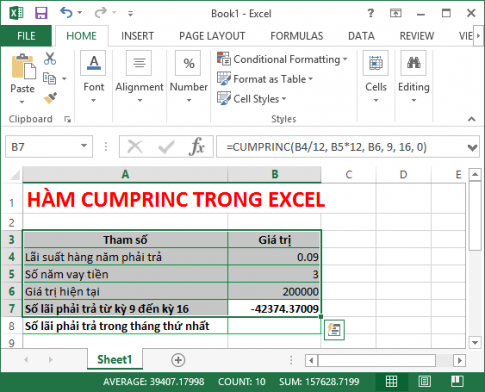

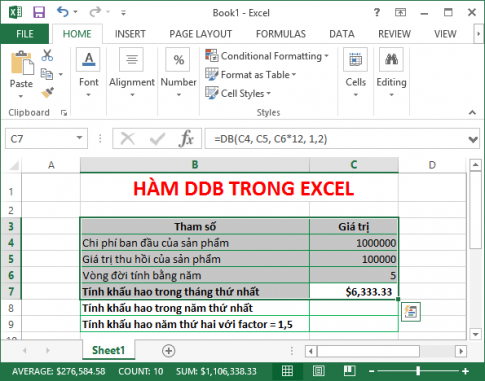

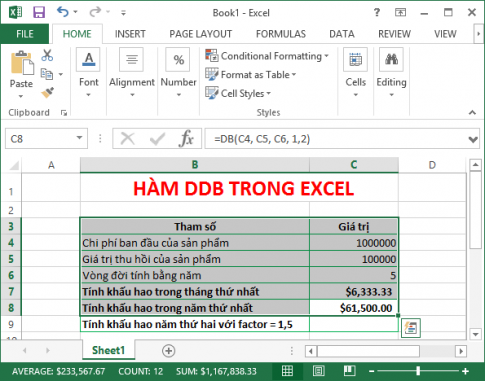

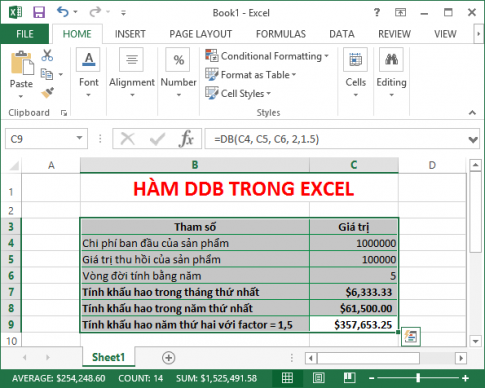

4 . DDB . function

- Function: Calculates the depreciation of assets for the specified period using the compound declining balance method

- Syntax: DDB(cost,salvage,life,period,[factor])

- Using:

-Cost: initial cost of the product, required parameter

-Salvage: value after depreciation (recovery value of the asset), required parameter

-Life: Number of depreciation periods, required parameters

-Period: Period you want to depreciate, required parameter

-Factor: Balance descending rate, if omitted will default to 2 (double reduction method)

Example: Given a spreadsheet with the data entered corresponding to the parameters of the DDB function in Excel, calculate:

– Calculate the first month's depreciation

-Calculate depreciation in the first year

– Calculate depreciation in the second year with factor = 1.5

Good luck !